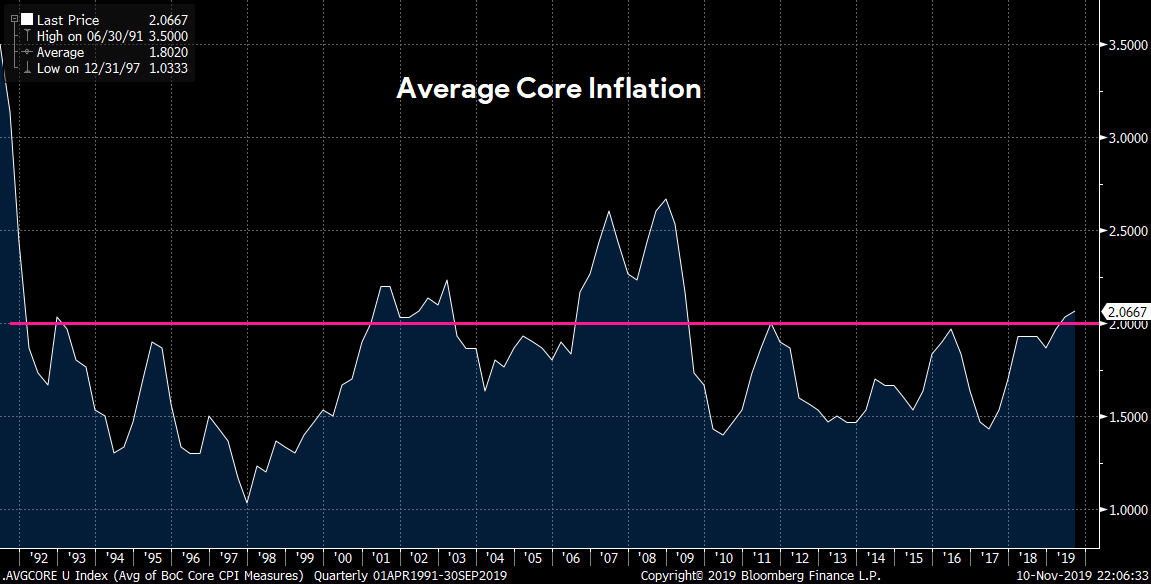

If you knew where inflation was headed, you’d have a great chance of knowing where mortgage rates were headed. The latter rises and falls with the former.

If you knew where inflation was headed, you’d have a great chance of knowing where mortgage rates were headed. The latter rises and falls with the former.

That’s why so many people try to predict inflation. Among the many who think they know where it’s going:

- The 100 senior Canadian businesspeople surveyed by the Bank of Canada every quarter

- 2 out of 3 believe inflation will remain at 2% or less in the next year

- Only 1% think inflation could top 3%

- The International Monetary Fund

- It forecasts 1.9% to 2.1% inflation through 2024

- The OECD

- Last year it predicted 2.06% average inflation through 2060

- Private sector economists

- The consensus forecasts 1.9% inflation through 2021

- The Bank of Canada itself

- It expects 2% inflation next year, right on target

These pros are fallible in their forecasts, so you can’t put too much stock in them. Nonetheless, it’s worth noting that virtually no one credible has been forecasting that core inflation will approach the Bank of Canada’s worry zone (3%+).

That’s not to be unexpected. For decades running, Canadian inflation has been remarkably contained. In over a quarter century core inflation has never even neared the Bank of Canada’s 3% limit, not even once.

In other words, the Bank of Canada’s 2% inflation target has helped create persistent 2% inflation expectations. That and a slowdown in Canada’s long-term economic growth rate have minimized the need for rate hikes.

Where Does Our Inflation Come From?

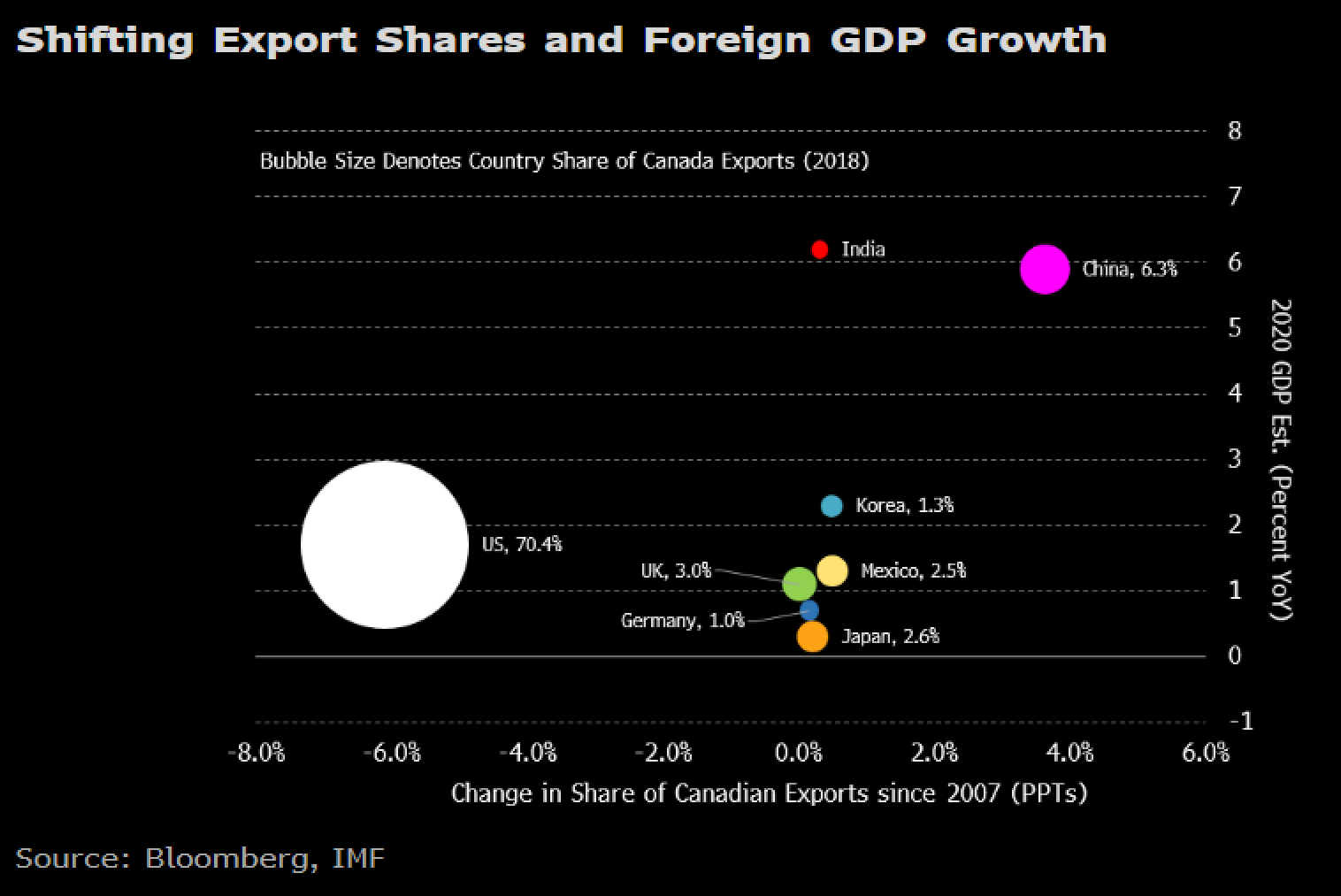

Much of Canada’s inflation is rooted in our trading relationship with the U.S.

This chart below shows how important of an economic (trading) partner America is. The U.S. is the big circle on the lower left.

The American economy is essentially our biggest external driver of inflation. It’s quite relevant, then, that expectations for U.S. inflation have been steadily declining.

What It Means

Interest rates track inflation expectations. Expectations today are for at- or below-target inflation over the next couple of years…or longer.

For that reason, expect no major increase in rates unless those expectations change dramatically. And few are betting on a sharp upturn in the North American inflation outlook, certainly not before the U.S. election in a year.

Even fewer believe the Bank of Canada has grounds to lift its key interest rate, which is already the highest in the developed world.

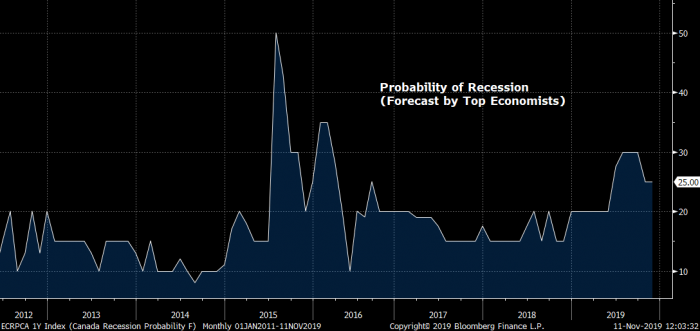

And we shan’t forget that 1 in 4 economists tracked by Bloomberg are still predicting a U.S. recession within 12 months. We likely won’t see one “in the next 6 months,” says Helmut Pastrick Chief Economist, Central 1 Credit Union. That “can be stated with a high degree of confidence…”

“And not in the next 12 months [either].” That, “with a lower, but still high degree of confidence. The further out one looks, the probability of a recession rises, however…”

As a mortgage shopper, one could assemble the above information and conclude there’s a reasonable risk-reward in taking the cheapest possible short-term full-featured fixed rate for their next mortgage. And if they were financially stable, creditworthy and risk tolerant, they’d probably be making the right move.

Data Sources: Bank of Canada, Bloomberg

log in

log in

5 Comments

So, how can I use this? …do I simply lock in for a short term, ignoring the full term for which I will be financing, since the future is unknowable? …perhaps I lock in for a long term since those rates are also relatively low, and I have no insight on what risk’s might arise in 2+ yrs?

If Albertans, pull a full-on country whiner strategy. I may, or may not, be refinancing in the midst of a vote for separation and potentially negative interest rates, as Forex markets and Ottawa respond. I’ve bought out a mortgage for a lower rate – Quebec cost me a bundle.

Or, maybe Trudeau2.2 might redo Trudeau 1.2 – nationalize the energy industry again. I’ve also been there before, and after, with 19% interest rates.

The short-term analysis here is most useful, for mortgage decisions, when placed in the context of a larger strategy. I don’t have the answers, but still have some big questions. Tx.

Also, 3 in 4 Bloombing economists are not predicting a recession in the next 12 months, but they could be wrong, but they wouldn’t be, but their assumptions could be wrong.

Short terms usually beat long terms. The inflation picture is simply all the more reason not to deviate from that strategy. I would just caution anyone who might not be able to pass the stress test in the future to consider a 5 year fixed instead.

Hi Pete,

Wish we could give individual mortgage advice in this forum but it’s not possible. Suffice it to say, those considering a shorter-term mortgage can arguably be comforted by the fact that inflation appears less of a threat in 2020 than it has in the past.

As for the recession predictors, 25%, while a low probability, is higher than normal. That and the fact that we may be closer to the end of Canada’s economic “expansion” than the beginning are two more hints of future disinflation. Those two factors will also put some minds at ease, particularly for well-qualified borrowers leaning towards the historical advantage of shorter terms.

Thank you very much for your insights. Predicting future political moves and those impacts on rates is ridiculous, so thank-you for avoiding it, I should have.

I have used ARM’s for some time and there has been a significant advantage. Unfortunately, short term or open ARM’s are not as available/competitive now. To me this may suggest too much confidence that the good times (sheap money, debt financed stimulation) will continue unabated in the foreseeable future. The market likes to occasionally make fools of most of the people and inverted yield curves seldom last long, so I was thinking of the the potential advantage (risk off strategy) on longer terms while that opportunity window is open. In contrast. the old maxim; ‘ the trend is your friend, until the end’ must be considered – I don’t see the end yet, either.

Thanks again

Thanks Pete, One of the most interesting phenomenons in the mortgage market right now is the inversion of fixed and variable rates. It’s interesting mainly because people are so convinced fixed is better because the rates are lower. No one is factoring in that the market prices things the way it does for a reason. Of course, the market is often wrong and there’s value in certainty. But, betting with the market usually gives you (at least a slight) edge over the long run, versus betting against it. It’ll be fun to see how the inversion plays out in the next year or two…