There’s an increasingly ominous vibe to Canada’s economic outlook, and that’s got the market taking rates down another notch.

Canada’s 5-year bond yield is seven basis points lower today—to 1.63% as we write this. That’s the lowest it’s been since December 2017. All told, the 5-year yield has now sank 83 basis points since the November high.

With the Bank of Canada seemingly taking rate hikes off the table and GDP down 3 out of the last 4 months, markets are now pricing in a greater probability of a rate cut this year than a rate hike. Albeit, prime rate is expected to remain flat at 3.95% through at least the spring.

Fixed Rates Tumble

Not surprisingly, we’re seeing fixed rate cuts O’plenty. In the 5-year fixed market, most big banks are now down to 3.49% or less on a discretionary basis while non-Big-6 lenders are 3.34% or below. (Don’t mind the bank’s higher advertised rates. They’re just a starting point for negotiation.)

Insured rates are even lower. Thus far, no one has matched HSBC’s aggressive 2.99% insured special (latest HSBC mortgage rates). That offer is making competitors pull their hair out. But it’s not that lenders can’t match it, they just don’t want to (yet). Gross margin on that rate, relative to bond yields, is now 136 bps—big enough to warrant matches from at least one or two competitors — especially given we’re entering the hyper-competitive spring market.

Interestingly, none of the big banks have cut their 5-year posted rates in months. Among other things, keeping higher posted rates let banks: (A) sell at bigger “discounts,” which increases their penalty revenue in the future, and (B) avoid having to reprice thousands of mortgages waiting to close.

Unfortunately (for borrowers with greater debt-to-income ratios), higher posted rates also keep the mortgage “stress test” elevated at 5.34%+, making it harder to get approved.

Mind the Spread

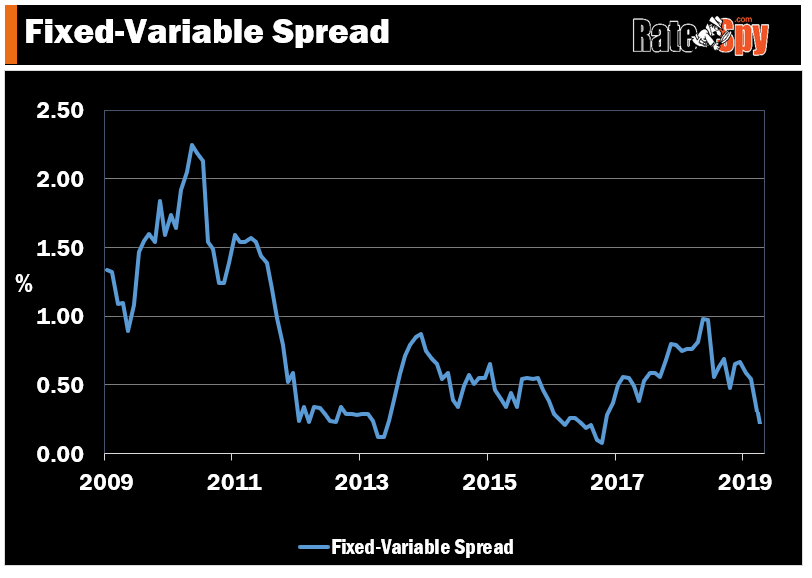

The Fixed-Variable spread (i.e., the difference between 5-year fixed and variable rates) is now just 19 basis points (0.19%-point) based on typical big bank rates.

That’s got more than a few mortgage shoppers thinking fixed rates are the way to go. As I wrote in the Globe last night, that’s a risky bet. The spread is narrowing because the market thinks rates will be flat or drop in the next year or two, and that’s a pro-variable trend.

log in

log in

There’s an increasingly ominous vibe to Canada’s economic outlook, and that’s got the market taking rates down another notch.

There’s an increasingly ominous vibe to Canada’s economic outlook, and that’s got the market taking rates down another notch.

4 Comments

Music to my ears as a variable-rate holder. The previous rate forecasts from economists saying rates would rise 3 or 4 more times simply didn’t make sense, for a variety of reasons. My skepticism has been proven right…at least for now.

I second that. To boost the economy, increasing the rate doesn’t make any sense.

When does the Spy expect the fixed rates to drop some more?

The 5 year GOC bond is touching 1.4%

Have you seen where fixed rates on 5 years drop below variable rate 5 year? (I would expect it to be highly unlikely, but inversions might be everywhere)

Thanks

Fixed rates are still dropping as we speak. Multiple lenders, including some banks, lowered several fixed rates again today.

Assuming we’re in the down leg of the business cycle, 5-year yields could easily fall under 1%. But my dog could probably give you a better idea of the timing of that than me.

It’s definitely possible for variable and fixed rates of the same term to invert. If you compare apples-to-apples — e.g., uninsured rates to uninsured rates with the same loan-to-value — the spread is already zero in some cases. Take 5-year fixed vs variable uninsured rates, both 3.19% as of today (we compared rates available in more than one province).