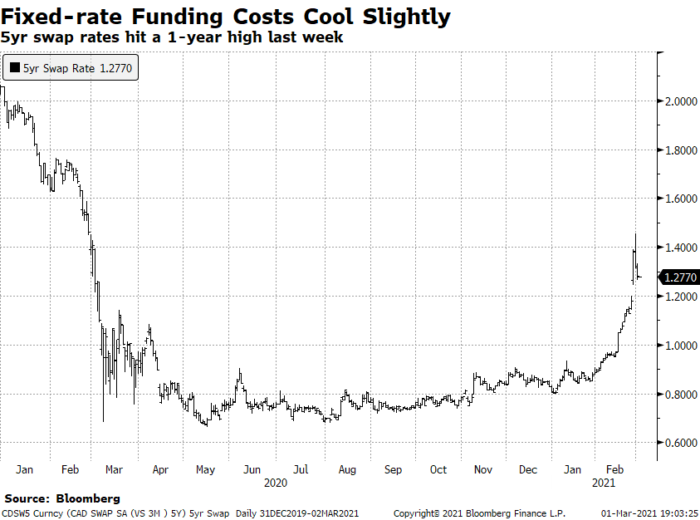

Monday was a reprieve from surging rates in the bond market. Canada’s 5-year swap rate, a good lead indicator of fixed mortgage pricing, fell back towards earth after February’s parabolic surge.

So far, four of the Big 6 banks have boosted fixed rates following that leap in funding costs. Here are some of the big names that jacked up fixed rates Monday. And note their variable-rate cuts as well.

BMO

- Canada’s fourth-largest bank raised the following special fixed rates on Monday:

- 5yr default-insured fixed (Smart Fixed): 1.93% to 2.09%

- 5yr fixed (Smart Fixed): 2.04% to 2.24%

- BMO lowered the following special variable rate:

- 5yr: 1.75% to 1.55% (Prime – 0.90)

HSBC

- Uber-rate-competitor HSBC boosted the following special fixed rates:

- 2yr: 1.64% to 1.74%

- 3yr: 1.79% to 1.89%

- 5yr (refi): 1.69% to 1.89%

- 5yr (high ratio): 1.44% to 1.69%

- 5yr (switch): 1.64% to 1.84%

- 10yr: 2.34% to 2.64%

- HSBC also lowered the following special variable rate:

- 5yr: 1.39% to 1.29% (Prime – 1.16)

- The bank added this variable rate as well:

- 5yr (purchase/switch): 1.24% (Prime – 1.21)

National Bank

- National Bank raised the following special fixed rates:

- 4yr: 2.04% to 2.19%

- 5yr: 2.09% to 2.24%

Rate changes keep coming in fast and furious, and by all anecdotal accounts people are overwhelmingly choosing fixed rates, specifically the 5-year fixed. (We monitor this via rate-click traffic on the site, broker/lender straw polls and deal flow to our sister brokerage).

As best we can estimate, variable rates are being selected less than 10-15% of the time based on these anecdotal measures.

Looking Ahead

Almost all of the most-competitive lenders have already hiked rates. Tangerine, home to Canada’s lowest-ever uninsured 10-year rate, is one notable exception.

Looking out through March, the trend suggests a higher probability of further rate increases than rate decreases. But there’s also a chance the Bank of Canada could talk down rates by its next rate meeting on March 10.

All the recent rate action has at least one prominent analyst worried. “…If we see another 30-, 40-, 50-basis-point increase in rates, that will be translated directly into mortgage rates in Canada,” CIBC star economist Ben Tal told BNN Bloomberg. “I would be very concerned, because this market is not ready for a brief 100-basis-point increase in mortgage rates, by any stretch of the imagination…”

Tal reminded viewers that Canada is a “price-taker” when it comes to mortgage rates, given America’s heavy influence over our bond yields. That’s concerning, given how fast the U.S. deficit is exploding (which should, at least theoretically, be bullish for yields on both sides of the border).

“We cannot control the five or the 10-year rate,” Tal says.

log in

log in