“It does look as though [rate] cuts have done their job.”

That was Bank of Canada chief Stephen Poloz in a CNBC interview today. It was the second time he’s provided this “forward guidance,” and it’s about the closest thing you’ll hear to him saying “rates are headed up — soon.”

Poloz’s statement was “the final straw” for BMO. It triggered a change in its forecast for the first rate hike in seven years. BMO now expects it next month, at the BoC’s July 12 rate meeting. Less than 30 days ago BMO was predicting April 2018.

Not everyone’s on the same page for July, though. Most econo-pundits are fortune-telling that hikes won’t start until (at least) later this year.

Either way, most mortgage shoppers will now be factoring in higher rates when selecting a mortgage term.

What the Bond Market Says

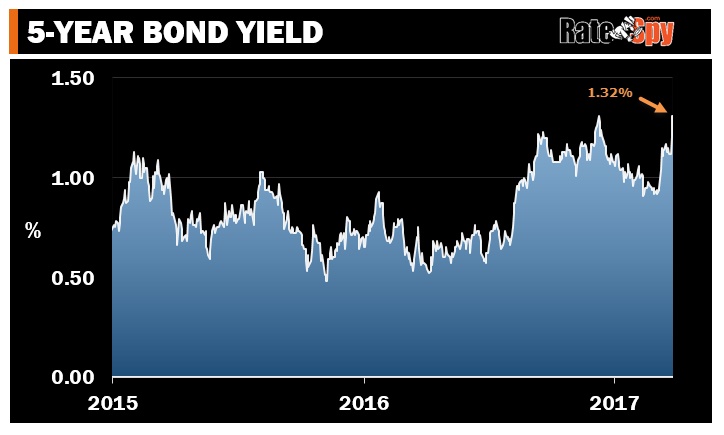

Bond yields, which drive fixed mortgage rates, have surged on the BoC’s sudden hawkish tilt. The chart below shows today’s high, which reached 1.32%.

We’ve already started seeing lenders announce fixed-rate increases. If the 5-year yield closes above its two-and-a-half-year high of 1.33%, we’ll see a lot more tout suite.

How to Play It

As per the Spy’s prior bulletins, lots of things (falling oil prices, U.S. trade barriers, persistently weak inflation, international incidents, a big housing selloff, a hostile move by the wingnuts in North Korea, etc.) could keep rates low, or even force eventual rate cuts. So erase any visions of prime rate doubling in the next five years. It’s just not a bet worth making.

In the meantime, it does look like the path of least resistance for rates is up, so here are four tips on how to play it:

- Don’t Panic: Borrowers could start flocking to 5-year fixed rates now that the BoC’s writing is on the wall. Shop hard and don’t overpay for 5-year money. It’s not unthinkable that the BoC reverses course in a few years after lifting rates 50-100 bps. Consider 3-year fixed terms too, especially if you can save 1/3 point or more versus a fixed-5.

- Beware the Conversion Rate: Lenders love to rope variable-rate borrowers into high lock-in rates. They’re not stupid. They know borrowers don’t want to pay a penalty to leave, or undergo the inconvenience of applying elsewhere. If you’re in a variable, please do not lock into your lender’s fixed rate without negotiating and comparing other lenders. Tell your existing lender you want to leave (even if you don’t) and ask for a penalty quote. If the retention rep on the phone won’t quote a low enough rate, call back the next day and try to get someone else. And always review the best 5-year fixed rates in the market first. Use competitors’ rates as leverage, but don’t expect your lender to match the lowest rates. It won’t. If all else fails, consider switching if your penalty is reasonable. A lower rate elsewhere can easily offset a 3-month interest penalty (albeit, not a big IRD penalty). Switching lenders takes just 4-5 hours of your life, for potentially thousands in savings.

- Two-Year’s Are Still Cheap: If you want a short-term or floating-rate mortgage, and can find a two-year fixed for about the same price, take it. A two-year protects you from a few rate hikes and provides more refinance flexibility. Two-year fixed rates are exceptional at the moment, with some below 2%.

- Some Variables Are Still Worth a Look: If you’re financially secure, need an insured mortgage and have less than 20% down, don’t write off variable rates completely. You can find some for 1.75%, or even 1.65%. And most variables have cheap penalties too, at just three-months of interest. The BoC would need to hike 100+ basis points for a 5-year fixed to cost less, based on interest alone. Can our economy handle 100+ bps of monetary tightening? Many think not.

log in

log in

2 Comments

So I just read about OSFI’s proposed new mortgage rule changes. Some seem prudent, but I’m curious about the proposal to stress test all uninsured mortgages now on top of the insured mortgages.

What immediate effect could this have on rates? (I’ll be renewing within the next couple of years and fear rates may be materially higher by then).

@Concerned

When it comes to rates for well qualified borrowers, OSFI’s proposals shouldn’t have a material direct impact.

For non-prime customers, some will be forced into paying higher rates because they no longer qualify with a bank.