President Trump has figured out how to get his way and force more rate cuts out of the Federal Reserve: Create trade panic.

Trade wars—exacerbated last week by Trump’s latest gambit—could cost the global economy up to $1.2 trillion and pressure the Fed to cut rates more than expected.

North American yield curves inverted further on this news, suggesting higher probability of recession.

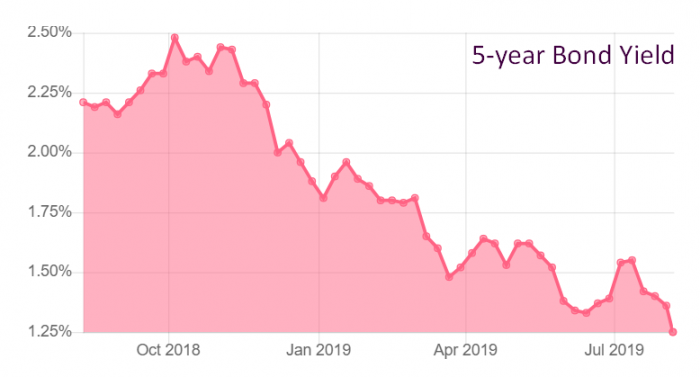

Given the market hates uncertainty, bond rates have plunged. Canada’s 5-year bond yield is down a hefty 15 basis points from Friday. That’s the lowest since June 2017. If we closed at these levels, it would be the biggest one-day plunge in yields in over four years.

Canada’s 5-year bond yield. Source: Bank of Canada, RateSpy.com

If the 5-year bond ends the week at these levels, we could easily see a downtick in the lowest 5-year fixed mortgage rates. It may happen regardless.

What Next

A 25+ basis point cut from the Fed on September 18th is almost guaranteed, if you believe bond market derivatives pricing.

Canada’s economy usually follows in the footsteps of the U.S. so the Bank of Canada will be under increasing pressure to cut its own key rate, if the Fed lowers again. The next BoC rate meeting is September 4. The market is now pricing in just a 1 in 6 chance it’ll yield any movement in our overnight rate.

As for the next BoC cut, it’s now expected in January (don’t read too much into this as market-implied rate changes fluctuate constantly).

Five-year fixed mortgages continue to be priced 10-15 bps below variables, and probably for good reason. The market seems to be signalling that the worst is yet to come for Canada’s economy, portending lower rates long-term.

Here’s the latest pricing on nationally available fixed-5s:

Here’s the latest on floating rates:

- Insured variable: 2.75%

- Insurable variable: 2.84%

- Uninsured variable: 2.90%

Talk of Zero Rates Intensifies

Market anxiety is running high. It’s times like these that you get commentators painting pictures of worst-case scenarios. Already we’re seeing more stories contemplating negative interest rates in Canada (example #1, example #2).

Market anxiety is running high. It’s times like these that you get commentators painting pictures of worst-case scenarios. Already we’re seeing more stories contemplating negative interest rates in Canada (example #1, example #2).

There’s no way to know if/when the Bank of Canada will get to zero. But, other things equal, as long as:

- Canadian bond yields remain much above other developed nations, and

- Our economy sputters along (without much inflation), and

- Canada retains its sacred AAA rating…

…Canadian bonds will attract ample demand. That’ll weigh on rates until such time as inflation expectations surprise to the upside.

log in

log in

4 Comments

As fast as the 5y bond yield dropped to a 2 year low, it rebounded 10bps today.

Oddly RBC still is offering a discounted rate of 2.94% with a 10bps additional discount if you ask for it. Still higher than the average fringe/non-bricks & mortar lenders.

The posted rate should be down another 25bps based on the average 5 year yield.

Hi Tbahz,

The day this story was written, the 5yr yield closed at a 2-year low. Today it closed only about 0.008 higher. The rebound occurred intraday today and it was quite a move. We’ll see how long today’s bottom lasts. The tendency in this downtrend has been for short-term lows to last about two months.

Regarding posted rates: The last time yields were this low, 5-year posted was 4.64%. Today we’re at 5.19%. So yes, 25 bps wouldn’t be asking too much.

So if I understand correctly, there a probability that fixed mortgage rates should go down further either in September or January 2020. But they are heading down for sure and possibly then we can see the trend restored to have variable lower than fixed.

Hi Gaurav,

The dates are impossible to predict but here’s one thing we know. In time, variable rates will once again be lower than 5-year fixed rates. And they will stay lower the majority of the time.

But it may take a while to get back to that normal.