The market is betting on rates heading higher this Wednesday. That’s bad news for mortgage shoppers.

The market is betting on rates heading higher this Wednesday. That’s bad news for mortgage shoppers.

Or is it?

One could argue that a rate hike on July 11 makes the fixed or variable rate decision even easier. Essentially the Bank of Canada is doing mortgage shoppers a favour.

Here’s why…

Closer to the Finish

The higher rates go, the nearer we get to the end of the rate hike cycle. The reason being: elevated rates slow inflation, a primary determinant of interest rate levels.

The Bank of Canada’s neutral rate, as estimated by the market, is just one point higher, give or take. That’s the rate where the Bank of Canada doesn’t need to keep tightening to ward off inflation.

For years, the neutral rate has steadily trended lower, partly because people believe inflation is anchored near 2% and partly because the economy is more sensitive to monetary tightening than ever before (50% more sensitive, says the Bank of Canada).

Of course, rates can always overshoot the neutral rate. But they don’t stay overextended for long, if history is a guide.

All that is to say, the risk of going variable instead of fixed (i.e., the risk of continued rate hikes) drops the higher prime rate goes.

The Average is a Magnet

Rates have a history of reverting to their long-term mean, partly because all economies are cyclical.

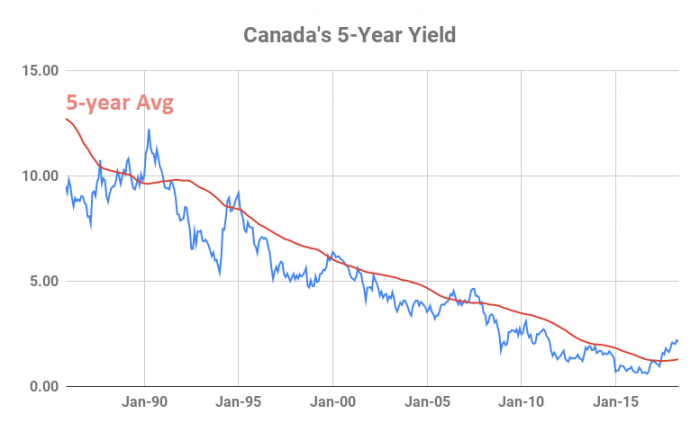

The 5-year bond yield is a good benchmark for rates in general and its 5-year average is a decent proxy for the mean, or long-term trend. Incidentally, five years is roughly how long the average economic expansion lasts.

Now here comes the most important sentence in this story. This spring, the gap between the 5-year yield and its 5-year average was at a 27-year high. Many people don’t realize that.

If you go all the way back to 1991, when the Bank of Canada started inflation targeting, whenever the 5-year yield gets that far above its mean, it’s been an opportune time to go variable.

Of course, the sample size of such occurrences is too small to draw reliable conclusions and moving averages are far from foolproof (especially after a long-term downtrend). And there’s always the outside chance that core inflation could unexpectedly run above the Bank of Canada’s 3% tolerance, prompting more rate hikes than expected.

But if you’re playing the odds and leaning variable, there are factors supporting mean reversion:

- The U.S. yield curve is already the flattest it’s been in over a decade (a harbinger of economic slowdown, some argue)

- The looming trade war could slow inflation and business activity worldwide, with Canada disproportionately impacted

- Over-leveraged consumers can’t spend as much as rates tick higher

- The housing falloff could be an economic drag.

You don’t need rates to plunge below their mean to win with a variable. You just need them to drift sideways or slightly up, long enough to touch the mean. That allows enough time to pass for a variable rate’s discount (versus a 5-year fixed rate) to work its magic. That’s on top of the potential penalty savings from a variable-rate mortgage if you decide to terminate before maturity.

According to a Reuters poll last week, most economists expect this Wednesday’s hike to be the BoC’s last for 2018. But it’s reasonable to expect more hikes in 2019. Factoring in four more 25 bps increases (one every six months), a prime – 1.00% variable still beats your typical 3.39% five-year fixed. So, for someone who can tolerate the tail risk of runaway inflation, variables are a worthy gamble.

log in

log in

4 Comments

Nice work aggregating the data.

The other benefit about a variable rate is if you need to get out of it, the penalty is only 3 months interest.

Thanks Ralph.

I’m wondering if your current variable interest rate is prime – 0.68% would you consider that worth staying the course or only if you have a prime – 1.00% or higher? We are one year into a closed 5 year variable and have gone from 2.7% to 3.2% in a 10 month span… trying to determine if locking in for 3.37% for 4 years is a wiser move, stay the course and just increase our payments to offset the interest increase, or pay the interest penalty and find a lower rate somewhere else entirely…it’s a tough call, but if our variable rate discount is crappy to begin with it might be worth converting….just not sure where the cut off for good vs. bad rate where variables are concerned…?

Hi Jodi, The market expects at least 2-3 more rate hikes. So your first question should be, can you handle a 3.77% rate?

If you can’t, and assuming you plan no changes to your mortgage for 4-5 years, then locking into a 4yr or 5yr rate near 3.37% may not be a bad play (assuming there’s no penalty).

If there is a penalty, you’d have to run the math to see if switching still makes sense given your objectives and risk tolerance.

Note that if your home was worth less than $1 million when you got your mortgage and you have 35% equity or an insured mortgage, you may be able to get much better rates than the ones you’ve quoted. That’s another case where it may make sense to pay a penalty to lower your rate.

Anyone who’s financially stable, risk tolerant and has a great rate (e.g., prime – 0.85%, prime – 1.00%, etc.) can afford to gamble that the Bank of Canada won’t hike more than three times. Moreover, when modelling out scenarios like this, it’s important to factor in the possibility that rates may fall in a few years, after the BoC is done hiking.

Either way, however, you always have to plan for the worst case (i.e., much more than 3 hikes).