By The Spy on

March 14, 2020

Prior to the last few days, consumers had expected falling Bank of Canada rates and lower bond yields to translate into cheaper mortgage rates. And they have, big-time. But these two benchmarks aren’t the only things that determine mortgage pricing. Borrowers were reminded this weekend that liquidity and credit risk are also in the equation. Ten days ago we noted...

read more

By The Spy on

March 7, 2020

Here’s the latest on mortgage rates following the maniacal once-or-twice-a-decade-type week we just had in the markets… Where Mortgage Rates Landed A quick look at this week’s major rate drops from the Big 6 banks: Prime Rate Banks slashed their prime rates on Thursday from 3.95% to 3.45%—the most since the credit crisis.That story. 5-Year Fixed Rates Typical big-bank unpublished...

read more

By The Spy on

March 6, 2020

If you ever wondered what bond yields would do if we were facing a potential nuclear holocaust, we’re getting a small taste of it today. We are seeing Canada’s 5-year yield, normally a key driver of fixed mortgage rates, crash for the second week in a row. This plunge in yields is eerily reminiscent of the vicious 2008 credit crisis,...

read more

By The Spy on

January 14, 2020

The 2020s won’t be the decade to lock into a long-term fixed mortgage, not if you believe RBC Economics. It’s projecting just 1.7% annual economic growth for the next 10 years, give or take. That’s roughly a full point less than before the Great Recession. At 1.7% GDP, there’s generally very little reason for rate hikes. Quite the opposite, RBC...

read more

By The Spy on

January 7, 2020

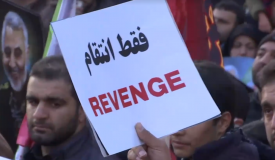

Iran is still miffed about the U.S. exterminating its #1 general. It’s reportedly contemplating 13 potential strategies for inflicting a “historic nightmare” on the American infidels. Apart from ensuring its own devastation, such a move would likely drive down Canadian bond yields. Five-year yields often drop during wartime asinvestors rush for safety in government-guaranteed securities. In the 1990 Gulf War,...

read more

By The Spy on

January 3, 2020

Here’s reason #5,369 why we don’t like to predict interest rates: war. Canada woke up this morning to the leader of Iran’s Revolutionary Guards’ Quds force being incinerated by a U.S. bomb. Iran’s Supreme Leader promised “severe retaliation” — whatever that means — and just like that, bond yields plunged. It was completely unpredictable. When global risk escalates, traders instinctively...

read more

By The Spy on

December 8, 2019

Canada just witnessed its worst spike in unemployment since the Great Recession of 2009. An estimated 71,200 jobs were lost in November. And we all know what happens when unemployment bottoms and starts climbing. Rates usually drop. Is This Really the Bottom in Unemployment? No one knows what tomorrow will bring (until tomorrow).But here’s what we know: Economic cycles have...

read more

By The Spy on

December 3, 2019

With just 12 days until Tariff Man’s next round of threatened tariffs kick in against China, and with new import taxes now threatened on Europe and South America, the market pendulum has swung back to pessimism. “If tariffs scheduled for Dec. 15 are implemented, it would be a huge shock to the market consensus,” Manulife Investment Management’s Sue Trinh told...

read more

By The Spy on

October 14, 2019

Bond yields erupted Friday for the biggest two-day gain since 2011. Canada’s 5-year yield—which is closely watched for its influence on fixed mortgage rates—closed at its highest point since July. This comes after the Trumpinator heralded a potential U.S./China trade truce. The trade war, now a year and a half old, has pounded mortgage rates on the assumption that weaker...

read more

By The Spy on

June 27, 2019

Not much going on this weekend. Only a little meeting between the world’s two most powerful leaders about 2019’s single most important economic issue. U.S. prez Trump and Chinese supreme head communist guy, Xi, collide over trade ahead of Saturday’s G-20 summit in Japan. And, batten down the hatches, because it has the potential to be a short-term tide changer...

read more

log in

log in