By The Spy on

March 17, 2015

It must be spring in the mortgage market. You can tell because BMO is making headlines again with a cut-rate mortgage. The bank announced today that it is slashing its Smart Fixed Mortgage rate to 2.79%. That’s the lowest advertised 5-year fixed rate of any big bank. Of course, most well-qualified borrowers knowthat banks routinely quote below their advertised rates....

read more

By The Spy on

March 6, 2015

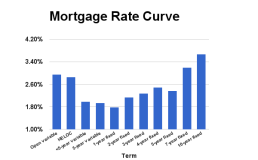

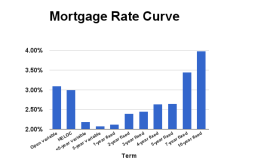

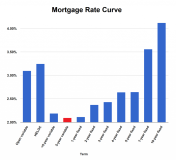

The chart below shows the average best rates for each mortgage term on RateSpy.com. This graph provides a sense for how much of a rate premium you’ll pay for the security of a longer-term and/or fixed rate. Key Takeaways: The difference (spread) between 5-year fixed and variable rates remains tight by historical standards at roughly 0.44 percentage points. The long-term...

read more

By The Spy on

February 23, 2015

If you look at RateSpy’s lowestrates for the Big 6 banks you’ll generally notice three things: 1) They refer to “discretionary rates” at the banks 2) They are estimates 3) They are usually the same for all six banks. Though it doesn’t seem obvious, there is method in this approach.The explanation starts with the mortgage pricing strategy used by major...

read more

By The Spy on

January 27, 2015

The 24% of us with variable-rate mortgages were starting to get nervous. Six days had passed since the Bank of Canada’s (BoC’s) rate cut and many feared the banks wouldn’t pass along that savings. Well, they did. Sort of. In not-so-generous fashion, the Big 6 banks all cut their prime rate by just 15/100ths of a percent. That’s instead of...

read more

By The Spy on

January 22, 2015

All eyes are on the Big 6 banks. The mortgage industry is waiting for confirmation on whether they’ll pass along the Bank of Canada’s rate cut by reducing their own prime rates. One major bank executive I spoke with characterized things like this: “Prime rate is not a business line call like, say, 5-year fixed rates. It comes from the...

read more

By The Spy on

January 16, 2015

The chart below shows the average best rates for each mortgage term on RateSpy.com. This graph provides a sense for how much of a rate premium you’ll pay for the security of a longer-term and/or fixed rate. Key Takeaways: The difference (spread) between 5-year fixed and variable rates remains narrow by historical standards at roughly 0.57 percentage points. The long-term...

read more

By The Spy on

December 11, 2014

I recently came upon a puzzling rate policy from a local credit union. Its website advertises: “You do not need the stress of shopping for mortgage rates! [We], your community credit union, will now MATCH the rate you are offered!” Say what? How does “matching” a competitor’s rate help someone avoid rate shopping? You’ve got to hand it to a...

read more

By The Spy on

November 17, 2014

The chart below shows the average best rates for each mortgage term on RateSpy.com. The graph provides a sense for how much of a rate premium you’ll pay for the security of a longer-term and/or fixed rate. Key Takeaways: The difference (spread) between 5-year fixed and variable rates remains tight by historical standards at roughly 0.55 percentage points. The long-term...

read more

By The Spy on

August 28, 2014

HELOCs (home equity lines of credit) used to be widely available at prime rate. That changed when the credit crisis inflated funding costs and drove up rates as high as prime + 1.50% and up. Now, five years after the financial system was seemingly on the verge of collapse, we’re finally seeingHELOC pricing near prime rate. Case in point is...

read more

By The Spy on

August 2, 2014

Mortgage rate widgets are no longer created equal. If you want to display mortgage rates on your website, do your visitors a service and display the best mortgage rates available.Only one mortgage rate widget in Canada makes that possible: RateSpy’s. Other rate widgets primarily show the lenders and brokers who pay to promote their rates. That does your visitors a...

read more

log in

log in