By The Spy on

May 8, 2019

You’ve probably never thought about not paying the principal on your mortgage. It sounds almost un-Canadian. But it’s a crazy-sounding idea that, in limited cases, is not so crazy. Out of thousands of home loans in Canada, only two products let you pay just the interest each month: A Home Equity Line of Credit (HELOC) An interest-only mortgage (I/O). HELOCs...

read more

By The Spy on

May 6, 2019

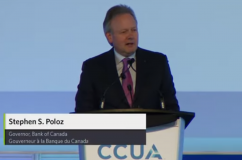

Three-decade-long mortgages are a mainstay in the U.S. mortgage market. But in Canada, 5-year fixed terms dominate the landscape.Forty-five per cent of mortgagors chose them last year, says the Bank of Canada. BoC chief Stephen Poloz wants to see that change. In what he termed a “call to arms,” he challenged the mortgage industry to think outside the five-year fixed....

read more

By The Spy on

May 2, 2019

It’s remarkable how much people focus on the Bank of Canada’s “neutral rate” nowadays. It has become a lighthouse in the rate fog. People rely on it to gauge how far we are from “normal” interest rates. If you’re not familiar with the “neutral rate,” it’s basically the theoretical overnight rate that neither accelerates nor slows the economy and inflation.Last...

read more

By The Spy on

April 30, 2019

You’ve probably seen the U.S. and China wrangling over trade in the news lately. Hanging in the balance is a major trade agreement—if they settle their differences (and they eventually will). Such an agreement would be historic. It would finally end their trade war while chipping away at America’s $419+ billion trade deficit (on goods) with China. A deal could...

read more

By The Spy on

April 29, 2019

Just failed the mortgage stress test and feeling down? Have no fear, a bigger down payment will get you to the mortgage promised land. By putting down more, you’ll lower your debt ratio and be passing the stress test before you know it…as long as you don’t expect a mortgage before 2031. That’s how long stress test flunkies would have...

read more

By The Spy on

April 26, 2019

The details on the government’s much-hyped First-Time Home Buyer Incentive (FTHBI) continue to trickle out. The latest clues on its operation come from Evan Solomon’s interview with CMHC CEO Evan Siddall. In that interview, Siddall comments on some lingering FTHBI question marks, namely: The Maximum Home Price The maximum home price under the First-Time Home Buyer Incentive ranges from $505,000...

read more

By The Spy on

April 24, 2019

The Bank of Canada’s decision to leave rates alone was far from its most important message today. More on that to follow, but first, here’s a quick take on what the BoC said this morning: Rate Decision:It left Canada’s key interest rate at 1.75% Prime Rate: Prime rate remains at 3.95% Market Rate Forecast: At least one rate cut by...

read more

By The Spy on

April 23, 2019

The gap between the best 5-year fixed rates and best variable rates is the smallest its been in two and a half years. We’re talking less than 1/8th of a percentage point between them. Depending on the equity a borrower has, folks can even find 5-year fixed rates that are below the best variable rates. What’s Provoking It One reason...

read more

By The Spy on

April 19, 2019

Mortgage regulation and higher rates changed the game in 2018, lowering the amounts borrowers could qualify for by up to 20% and reducing the incentive to renegotiate for a better rate. That had clear implications for refi volumes. UsingTeranet‘s 2018 Ontario data as a guide, the number of borrowers: refinancing with their existing lender plunged 36% (vs 2017) switching their...

read more

By The Spy on

April 17, 2019

It’s no secret. Many homebuyers that had no trouble qualifying for a mortgage in 2017 are finding big challenges in 2019. As we wrote yesterday, the government’s harsher mortgage “stress test” is a key reason why. The problem is exacerbated by the banks’ refusal to lower their posted 5-year fixed rates, despite a 55-basis-point drop in the 5-year bond yield...

read more

log in

log in