It’s been seven weeks since the Bank of Canada began its first rate hike cycle in seven years. But with its next meeting on Wednesday, will it pull the trigger again?

It’s been seven weeks since the Bank of Canada began its first rate hike cycle in seven years. But with its next meeting on Wednesday, will it pull the trigger again?

Derivatives prices imply there’s a 50% chance it does, and a 100% chance that it hikes by October. Prime rate would jump 1/4%-pt if the BoC does move.

“We narrowly favour October over September, as skipping a decision date helps signal to markets that hikes will be gradual, and thereby reduces any further appreciation for the (Canadian dollar),” wrote economists recently at CIBC. They added, “holding rate hikes next year to 50 basis points would allow the BoC to monitor how indebted households are coping.”

But that was before yesterday’s blockbuster GDP report. Canada’s economy is blazing ? and it’s got economists scurrying like mice to ratchet up their 2018 rate projections.

“However, at this point,” writes BMO, “We doubt an October rate hike will mark the start of a quarterly rate-hike pattern, given (1) the risk of strengthening an already-strong Canadian dollar [and] (2) slow core inflation [which is] proving to be more persistent, and (3) keeping in mind continued uncertainty and financial system vulnerabilities…As before, we see subsequent rate hikes in April and October 2018, and more frequent ones afterwards.”

Looking out to 2018

Economic forecasts have the reliability of a chocolate teapot. They’re continually revised (i.e., wrong).

That said, bank economists are getting noticeably more hawkish, and there’s a reason for it.

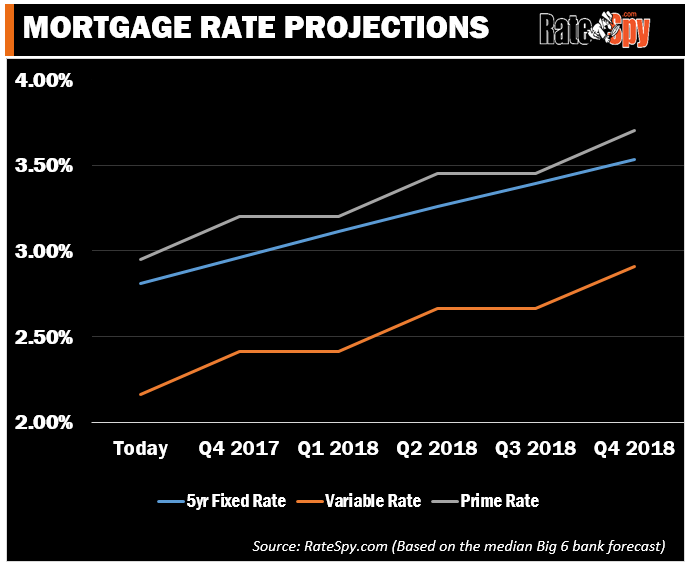

If you average the Big 6 bank forecasts, they’re now currently calling for an additional 25-bps rate hike before the end of the year, followed by two more quarter-point hikes in 2018.

If that happened, it would put prime rate at 3.70% by the end of next year (it’s 2.95% now). In turn, interest expense would jump by roughly $1,150 over five years on a typical adjustable-rate mortgage, for every $100,000 owing.

On the fixed-rate side, it’s a question of what bond yields do (since the two are linked). Based on where econs see bond yields heading, they’re suggesting a 35% increase in the average 5-year fixed rate.

If all of these economic forecasts prove accurate (said miracle notwithstanding), the average 5-fixed would jump from 2.81% today to 3.53% by the end of 2018. The average 5-year variable rate would rise from 2.16% to about 2.91%. Those hikes may not capsize the housing boat, but they’d definitely take wind from its sails.

log in

log in

1 Comment

I agree with the forecasts of another 25bp hike by the end of the year, but not two more in 2018. We have yet to see the full deflationary effect of the dollar. One quarter ago the USD was 135c, and now it is 124c, making imports priced in USD 8% cheaper. I just can’t see how we’ll get to 2% inflation if the overnight rate target goes from 0.5% to 1.5% in little more than a year.

WTI futures indicate US$50 for the next few years, so it will only be a soft recovery for Canadian oil & gas companies. I think most people agree real estate is cooling off, so two big parts of the economy are won’t be helping to push inflation higher.